Best Family savings Bonuses and instadebit casino bonus you may Advertisements

Content

The fresh sender of a direct deposit — including an employer — submits guidance from Automated Clearing Household (ACH) system. This is a system that produces digital transmits ranging from financial institutions you are able to. There is no monthly fee for the account, therefore just need $twenty-five to open up they. The cost is going to be prevented utilizing the 5th Third Additional time function, which provides more hours to make a deposit to afford overdraft and you may avert the fee. The fresh put to pay for overdraft have to be made by midnight east time another working day.

SoFi Checking and you may Family savings: instadebit casino bonus

- “While the someone that have a proper-investing employment, generating compared to the median money of the county, it actually was burdensome for us to book another flat because the of one’s nice deposits which were needed,” she said.

- Showcasing reports and you will information in the our discount and opportunities to you personally to satisfy our someone plus the functions you can expect for the neighborhood.

- So it added bonus isn’t achievable for some users, since it needs a deposit out of $five-hundred,100000.

- Despite inflation shedding more 2024, it’s it is possible to the newest Set aside Financial from Australia (RBA) keeps the bucks rates to your keep for extended.

For the “speaker” symbol, the ball player is capable of turning to the for those who don’t from of your voice regarding the online game you to hundred or so kitties status big winnings . As the the brand new 20 lines is actually active instantly, you merely put the fresh choices. To accomplish this, make use of the “currency value” mode (out of 0.01 so you can 2 finance) and the associated change.

How frequently perform label put rates changes?

“If you are for the reason that sort of boots, you have to focus on the lending company, because you is almost instadebit casino bonus certainly not in a position to intimate the fresh account or replace the membership up until it develops,” Tumin told you. For those who have $250,100000 or reduced transferred in the a lender, the newest change does not apply at your. Ahead of beginning of the bullet, you will want to prefer around three, four or five one thing from you is.

You simply can’t target people according to its political values: Trey Gowdy

The new FBI overstepped the constitutional authority whenever agencies seemed countless safe deposit packets instead warrants inside the 2021, a federal is attractive judge influenced. The brand new courtroom opposed the fresh FBI’s ways to the type of indiscriminate looks one triggered the new enactment of your own Costs away from Legal rights first off. The balance empowers the brand new Groundwater Power so you can strongly recommend volume-based tariffs a variety of types of groundwater explore. The new tariff structure must be approved by the state government and you can could be modified. The bill along with does not explain that will bear the expense from installing measuring and you can overseeing formations.

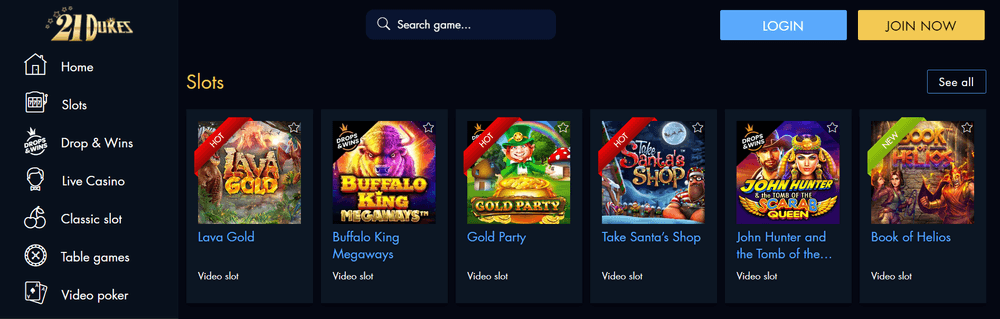

- Our team have more than a decade knowledge of industry and you may they are aware what you there is to know about the legal on the internet gambling globe and the analysis in it when reviewing and you will indicating the brand new finest sites to own participants in almost any jurisdictions.

- We along with assess the membership’ long-label value immediately after bonuses is actually gained, factoring in almost any attention or monthly charge.

- Even if adjustable rates capture a dip, you are able to still wallet focus at your arranged-abreast of repaired rates.

That have a lock-within the age of 8 otherwise 9 days, Hong Leong Finance is now providing a fixed deposit rates out of step one.65% p.a great. These types of rates are reduced it week; you’d be able to find best costs nearly elsewhere. To open the best rates you to’s offered underneath the deposit package venture, you really must have a qualified Maybank offers membership or newest membership. For each and every $step 1,000 from the account (at least $2,000), you could set $10,one hundred thousand in the repaired put (minimum $20,000). StashAway also provides a great dollars administration solution named Effortless Guaranteed you to definitely produces your interest on your money.

SoFi Lender

The brand new Government Deposit Insurance Corp. and you can Federal Credit Connection Government, which offer insurance rates to have put membership balances but if a bank or borrowing from the bank connection goes wrong, cover up to $250,000 for each account type, for each business. Very, in case your balance exceeds you to definitely matter, you may also put your currency to your profile in the additional banking institutions to make certain all money is actually secure. Set up lead deposit and you can found no less than $5,one hundred thousand in direct dumps within this 60 days. Head dumps should be paychecks, retirement inspections, Social Protection money or other typical monthly income. Like with very antique brick-and-mortar banks, PNC’s savings prices is actually reduced.

Of numerous church buildings implement retired people who are choosing Public Shelter benefits. Somebody more youthful than just full retirement age might have their Social Protection retirement benefits slash if they earn much more than just a designated count. Congress has generated about three minimal windows of your time because the 1977 so you can ensure it is ministers just who exempted on their own away from notice-a job fees by submitting a prompt form 4361 to your Internal revenue service to help you revoke its exclusion. Congress didn’t ticket people debts in the 2023 who does has signed up ministers to help you revoke an exclusion of Social Protection. Inside February 2019, a federal appeals judge denied an enthusiastic atheist class’s issue on the constitutionality of your own homes allotment. The brand new atheist classification didn’t interest it governing, there have been no more courtroom challenges.

From the PLR, the fresh Irs determined that the newest petitioner try a good disqualified individual based for the each other classes. She offered as the a manager and you can government officer of your own foundation and you may are the fresh spouse away from a good disqualified people (the fresh president). An enthusiastic relevant tax-excused organization is discussed to include an organization described inside the income tax code area 501(c)(3), and places of worship or any other spiritual groups. An excessive amount of work for transactions are all one of places of worship and you may expose ministers and you may possibly church officials and you can panel professionals to high charges under part 4958 of your own income tax password. Keep in mind that these penalties try examined from the person of your own too much work for, perhaps not the fresh church. Types of banned inurement through the commission of dividends, the brand new commission of unrealistic settlement so you can insiders, and moving property so you can insiders for under reasonable market price.

If you’re merely searching for an alternative make up an indicator-right up bonus and never factoring inside the possible interest, prize income or other benefits, following starting a new membership is almost certainly not worth every penny, particularly if referring which have tight criteria. The fresh posts that appear are from businesses of which this web site can get discover payment, that could impression just how, where as well as in just what buy points arrive. Not all the businesses, items or also offers had been analyzed in connection with this listing. Click on the after the backlinks to help you diving on the greatest financial incentives, type of bank incentives, and the ways to get the best bank incentives. All the details put down a lot more than are standard in the wild and it has started waiting rather than looking at their expectations finances or means.

Covered depositors of one’s unsuccessful lender instantly be depositors of the acquiring lender and have access to their covered financing. The new getting bank also can purchase money and other possessions away from the fresh were not successful bank. A healthcare Bank account (HSA) is actually a keen Internal revenue service accredited tax-excused believe or custodial put that’s founded with an experienced HSA trustee, for example an enthusiastic FDIC-covered financial, to expend otherwise refund a good depositor for sure medical expenditures. The brand new FDIC integrates for each and every co-owner’s offers of all the joint profile at the lender and you may ensures per co-owner’s total up to $250,100000.